Transnational Corporations

Transnational Corporations

Globalization - The New World Order

by Douglas V.

Gnazzo

February 9, 2006

"Corporations have been enthroned. An era of corruption in high places will follow and the money power will endeavor to prolong its reign by working on the prejudices of the people . . until wealth is aggregated in a few hands. . . and the Republic is destroyed."

[Abraham Lincoln]

Abstract

The modern corporation has come a long way since the Dutch and British East India Companies of the 1600’s, nevertheless the goal remains the same: to establish a monopoly of all trade within their sphere of influence – while continually expanding their territory.

In today’s world, companies that transact business in more than one nation are referred to as transnational corporations. These international conglomerates are the progenitors of globalization: the lust of want that roams the land in search of profit.

Globalization is the modern day’s call to arms of all lords and nobles. As used within this paper, globalization refers to the ever-increasing sphere of collective processes that consciously span the world, seeking new markets for their overlords: all in the pursuit – of that which has yet to come.

"We are witnessing an unprecedented transfer of power from people and their governments to global institutions whose allegiance is to abstract free-market principle, and whose favored citizens are soulless corporate entities that have the power to shape and break nations." [1]

THE BEGINNING

Originally, trade occurred on the local level by the use of barter: the direct exchange of one good for another. As commerce expanded, it became evident that a more efficient form of exchange was required, to better handle the increased complexity of the division of labor within a burgeoning marketplace. Indirect exchange soon came to be the preferred form of exchange. Indirect exchange uses a common medium of exchange: money.

Commerce eventually progressed from one region to another. As man’s ability to travel the earth increased, his ability to trade in non-local regions or markets increased as well. By the first century A.D., trade took place from Europe in the East to China and Japan in the West.

The Age of Exploration

The old world trade routes connected one market with another, especially the spice and silk routes. Control of the trade routes has been the coveted goal of the same families for centuries upon centuries: the will of conquest handed down from generation to generation.

The powers-that-be are still fighting over the sacred ground in the Middle East, still searching for the third note of the lost chord that has yet to be sounded.

The Middle Ages witnessed the age of exploration. Trans-Atlantic voyages in search of new worlds and new trade routes became the coveted prize. The hands of time steadily progressed from the Old World to The New World.

The Age of Aviation

With the advent of the airplane international trade became much more accessible to a greater number of people, spanning a much larger area. Once computers and modern communication were developed, trade could take place instantaneously from one end of the world to the other.

Advancements in transportation and communications increased economic globalization, not only spatially, to the four corners of the globe – but instantaneously in the temporal world as well. The boundaries of both space and time were under siege.

No stone has been unturned. No longer is it a race to round the Cape of Storms; no longer is it a race to the moon – now it is a contest for overlord of the universe; all players pay homage at the altar of Lucre; and he worships yet another. The suitors of the whore of Babylon know no respite.

"The recent quantum leap in the ability of transnational corporations to relocate their facilities around the world in effect makes all workers, communities and countries competitors for these corporations favor. The consequence is a race to the bottom in which wages and social conditions tend to fall to the level of the most desperate." [2]

Trade is no longer confined to the local, state, or national level; it now expands across the entire globe – ushering in the new world order of transnational globalization. The pursuit of profit has spread her shadow far and wide. Nevertheless, the winds of change detect a subtle undercurrent – as destinies child walks the face of the earth.

CORPORATIONS

The word corporation is from the root corpus – a body. Corporality is to have bodily existence or substance. To incorporate means to make into a body. A corporation is a legal entity or structure created according to the authority of the laws of a particular state.

Groups of people form legal corporations as bodies or entities to conduct business. The individuals are shareholders or members of the corporation. The corporation is a shell that individuals work in and through – a shape that constantly shifts to fulfill the desires of the seekers of profit.

In the Eyes of the Court, the Corporation Exists as a Legal Being or Entity.

The legal entity's existence is separate and distinct from that of the shareholders or individual members. A corporation, however, can legally act the same as a person can. It can enter into contracts; hire and fire people; sue and be sued; pay taxes; and do whatever is necessary to legally conduct business.

In addition, because a corporation is legally an entity in its own right, it is liable for its own debts and obligations – separate from its shareholders or members.

This is the reason corporations exist: to allow individuals to have limited liability, while retaining the power to do business and incur profits, while at the same time being...

Legally Shielded From The Corporation's Liabilities And Debts.

In layman’s terms – it is being able to have your cake and eat it too. The corporate structure is truly an amazing construct, and is unquestionably deserving of further legal review. Its footprints traverse the land, leaving behind indelible marks that bare witness to that which comes after.

TRANSNATIONAL CORPORATIONS

Corporations that have transcended local, state, and national boundaries are international entities, transacting business across national borders on a global basis – hence the name transnational corporations.

Following Word War II the League of Nations gave birth to the United Nations. International relations took center stage. The Bretton Woods Accord provided the script for the leading actors: the World Bank and the International Monetary Fund.

Who stands behind the World Bank and the International Monetary Fund? Who had the authority to sanction international institutions to control world finance? Does our Constitution grant powers to international institutions? Cui Bono?

Remember this well: a corporation is a structure that is used by its members for doing business through – it is the members or stockholders, real live people that gain from what the corporation does.

Corporations Only Answer To Their Dominant Stockholders

Bretton Woods established an international system of regulations to manage the financial transactions of world capitalism. In order to implement the master plan, the International Monetary Fund (IMF); the World Bank (WB); and The Bank For International Settlements (BIS) were created.

The intended goal was the integration of individual national economies into one unified global market – hence the term globalization. In 1995 the World Trade Organization (WTO) was specifically created to facilitate the expansion of international trade and direct foreign investment across the globe.

THE MONEY TRAIL

It is often said, "follow the money," so let’s follow the money and see where it brings us.

The United Nations Conference on Trade and Development states that:

“World Investment Report 2005 presents the latest trends in foreign direct investment (FDI) and explores the internationalization of research and development by transnational corporations (TNCs) along with the development implications of this phenomenon.” [3]

In the preface to the World Investment Report 2005, Kofi A. Anann, Secretary General of The United Nations states:

“The globalization of production is reshaping the international economic landscape. With that, the conventional wisdom of developed countries as capital and technology exporters and developing countries as importers is gradually giving way to a more complex set of relationships. The geography of international investment flows is changing. Developing countries are emerging as outward investors, and their importance as recipients of foreign direct investment in more knowledge-intensive activities is increasing. The World Investment Report 2005, focusing on the internationalization of research and development by transnational corporations, illustrates some of these changes.”

“These recent trends have important implications for the international division of labour. The traditional view, of more complex production activities being undertaken in the North and simpler ones in the South, is less and less a true reflection of the reality. Firms now view parts of the developing world as key sources not only of cheap labour, but also of growth, skills and even new technologies.”

“As transnational corporations are the dominant players in the creation of new technologies, it matters where they undertake their research and development. Currently, only a few developing countries attract such activities on a significant scale. Most low-income countries are not participating in global research and development networks, and consequently do not reap the benefits that they can generate.” [4]

In a press release dated 1/23/06, the United Nations Conference On Trade And Development stated:

“Foreign direct investment worldwide surged to an estimated US $897 billion in 2005 - up 29% from the preceding year - and a four-year slump in flows to developed countries was sharply reversed, according to UNCTAD data released today.”

“FDI inflows rose from US $415 billion in 2004 to US $573 billion in 2005. The bulk of this increase was accounted for by increased investment in the United Kingdom, which reported inflows of US $219 billion, twice that of the United States. This is the highest figure ever recorded for a European country.” [5]

Who Gets The Money?

The above statistics clearly show that the United Kingdom received the largest inflows of foreign direct investment. It is easily understandable that the $219 billion that the United Kingdom received was the highest figure ever recorded by a European country; however, such statistics seem to be at odds with the preface to the World Development Report 2005 where it stated:

“The geography of international investment flows is changing. Developing countries are emerging as outward investors, and their importance as recipients of foreign direct investment in more knowledge-intensive activities is increasing.” [6]

Going back to the press release from The United Nations Conference on Trade and Development dated January 23, 2006; we find some very intriguing data:

“Developing countries: Overall, FDI inflows to the developing world continued to rise in 2005 - they were up 13%, to an estimated US $274 billion. Following 2004´s significant increase of 41%, this brought FDI to the highest level ever for developing countries. There were increases in all sub-regions.” [7]/p>

As the statistics show, foreign direct investment in developing countries grew by 13%, to an estimated $ 274 billion. However, the total FDI of developed countries stands out markedly in contrast to the developing countries:

-

Developed counties - $573 billion

-

Developing countries - $274 billion

One would think that the less developed countries would receive more than half the amount of investments as compared to the already developed countries of Europe and North America; however, the data shows that they did in fact only receive half as much.

And this is after a 41% increase from the year before, which means that in the last few years the amount of investment in the developing world has been mostly talk as opposed to action. The percent of increase sounds good because it is starting out from such a low level. The raw numbers placed face-to-face show what is really occurring.

The data for investment in the world’s poorest areas reveals a truly sad situation that is not getting much better. Africa contributed a mere 2.3% of world trade, received 1.7% of global direct foreign investment, and devoted 0.7% of all expenditures to research and development, and this includes South Africa.

Such A Condition Is A Disgrace To Humanity – And Needs Not Exist.

It truly is a conundrum to comprehend how countries that are home to civilizations dating back thousands of years are so undeveloped in comparison to the United States, which has only been around for a few hundred years yet rules the world. Wonders just never cease.

Rich Man – Poor Man

The disparity between those that have, and those that have not, stands out exposed in its nakedness, cast off as the shadow of world domination that it is a witness thereto.

As the executive summary of the 2005 World Development Report states:

“The principal message of the World Development Report 2005 of the World Bank to the developing countries is that they should adopt liberal policies related to foreign investment to spur economic growth and development, and that the development of binding multilateral rules relating to foreign investment would create a favorable climate for foreign investment in developing countries. This is the same argument made by the developed countries for developing new rules on investment liberalization in the WTO and in bilateral agreements with developing countries.

However, such a message, when articulated in the context of the World Bank or in the context of the WTO, simply promotes the economic interests of the North. It disregards or downplays the fact that the promised developmental benefits of investment liberalization by developing countries have not yet, by and large come about. FDI inflows, despite investment regime liberalization in many developing countries, continue to go, in large part, to developed countries and to only a few developing countries. In fact, relative to the share of FDI inflows of developed countries, the share of developing countries in general and of the poorest among them in particular, has been on the decline.” [8]

In addition, the report adds:

“Despite the preceding words of caution, the key message of WDR 2005 is that for governments at all levels, a top priority should be to improve the investment climates of their societies. To do so, they need to understand how their policies and behaviors shape the opportunities and incentives facing firms … The agenda is broad and challenging, but delivering on it holds great promise for reducing poverty and improving living standards.

However, the authors of the report make no effort to provide empirical evidence in support of the sweeping assertion that increased FDI flows would lead to reduced poverty and higher living standards in developing countries.

The report also contains no evaluation of the levels of gross and net flows, of the quantity versus the quality of foreign investment and of the country and sectoral composition of these flows. An analysis of all these aspects of foreign investment is needed to determine the net benefit.” [9]

On Who’s Watch?

Perhaps the answer for such disparity lies within the actual structure of the entities that dominate world trade: the transnational corporations. These giants of industry know no bounds or limitations as they scour the earth in search of profit.

Is it possible that entities that have no boundaries or limitations are thereby unrestrained? Who has the authority to govern transnational corporations? Do they answer to anyone, or are the self-centered desires of their majority shareholders the only voice they heed?

“International human rights law generally imposes obligations on States, although some exceptions do exist, for example, in relation to armed groups. States parties to human rights treaties have the obligation to protect individuals and groups of individuals from the actions of third parties, including business entities.

The process of elaborating a statement of universal standards on business and human rights would raise the question of the legal status of that text and whether it would impose direct legal obligations on business with regard to human rights.

The Commission might wish to consider further the effect of imposing direct legal obligations on business entities under international human rights law and how such obligations might be monitored.”

“In considering the responsibilities of business with regard to human rights, it is important to reiterate that States are the primary duty bearers of human rights. While business can affect the enjoyment of human rights significantly, business plays a distinct role in society, holds different objectives, and influences human rights differently to States.

The responsibilities of States cannot therefore simply be transferred to business; the responsibilities of the latter must be defined separately, in proportion to its nature and activities.”

“There is also a question of how to ensure respect for human rights in situations where effective governance or accountability are absent because the State is unwilling or unable to protect human rights - for example due to a lack of control over its territories, weak judiciary, lack of political will or corruption. A lack of appropriate regulation and enforcement by the State could fail to check human rights abuses adequately while also encouraging a climate of impunity.

A particularly complex issue involves the regulation of companies headquartered in one country, operating in a second and having assets in a third. There is concern that business entities might evade the jurisdictional power of States in some situations, which could lead to negative consequences for the enjoyment of human rights.” [10]

Making matters even more complicated are the many different categories of agreements, most of which end up being nothing more than a scolding or slap on the wrist of the party under review. Some are binding others are not. Some are between States with other States; others are between States and companies, etc.

“The following criteria are relevant to understanding the legal status of initiatives:

(a) Binding on companies. Constitutions and national legislation in many States include human rights responsibilities that are binding on companies. Companies themselves might also make human rights initiatives binding through inclusion of specific terms to that effect in contracts.

(b) Binding on States. International treaties such as the principal human rights treaties are binding on States parties. While international declarations are not binding on States, they do indicate a level of commitment on behalf of the State to uphold the principles in the instrument.

(c) Non-binding. The bulk of existing initiatives on business and human rights fall within the category of non-binding.”

“While each of these initiatives and standards do include references to the promotion and protection of human rights, the treatment corresponds to the relevance of human rights in relation to the overall objectives and scope in each initiative.

Thus, the ILO Tripartite Declaration specifically includes workers’ human rights, but not others, while the Global Compact refers to human rights generally without going into any specificity of which human rights are relevant.

The references to human rights in the OECD Guidelines also lack specificity. As a result, there is still a gap in understanding what the international community expects of business when it comes to human rights.” [11]

Enforcement

After wading through the mire of binding and non-binding agreements, agreements versus declarations, guidelines against rules, one finally stumbles upon the issue of enforcement.

Even if a ruling is binding, as is an international treaty between nation-states, there still remains the question: who enforces the treaty if one party decides not to abide by the agreement? The United Nations Security Council now enters the field.

“The Security Council of the United Nations has primary responsibility under the UN Charter for the maintenance of international peace and security, and its resolutions are binding on all member states.”

“The Security Council may also take enforcement measures which are more robust than peacekeeping. These enforcement powers are contained in Chapter VII of the Charter, which authorizes the Council to determine when a threat to, or breach of, the peace has occurred, and authorizes it among other things to impose economic and military sanctions.

The ‘peace’ referred to in Article 39 may involve conflicts other than those between states. At the time the Charter was established, it was envisaged that conflicts within the borders of a state could also constitute a threat to or breach of the peace, and thus that the Council could order the use of enforcement measures. The Council has broadened its definition of these cases over time, so that gross violations of human rights may now be seen as a threat to the peace, as was the case with the genocide in Rwanda.” [12]

Transnational corporations are powerful entities. The combined revenue of the top four conglomerate giants is larger than the gross domestic product of all but the top twelve independent nations of the world.

THE POWER OF MIGHT

The World Trade Organization is a consortium of member countries, including the largest nations in the world. Yet, the huge transnational corporations exert persuasive influence on both the agenda and rules of the World Trade Organization.

If four or more of the top ten transnational corporations collectively want something done, there are few stalwarts to stand in their way and survive.

As the name implies, these companies are transnational in structure: meaning they are not directly subject to the rule of any individual nation. In fact, many of the transnational corporations are larger than most nations in strictly monetary terms of economics and finance. Only international treaties offer binding resolutions with these giants of industry.

The following two tables show the revenues of the top 50 transnational corporations and the gross domestic profit of each of the 50 largest nations.

TRANSNATIONAL CORPORATIONS

|

Rank |

Company |

Revenues (millions) |

Profits (millions) |

|

1 |

Wal-Mart Stores |

287,989.0 |

10,267.0 |

|

2 |

BP |

285,059.0 |

15,371.0 |

|

3 |

Exxon Mobil |

270,772.0 |

25,330.0 |

|

4 |

Royal Dutch/Shell Group |

268,690.0 |

18,183.0 |

|

5 |

General Motors |

193,517.0 |

2,805.0 |

|

6 |

Daimler Chrysler |

176,687.5 |

3,067. |

|

7 |

Toyota Motor |

172,616.3 |

10,898.2 |

|

8 |

Ford Motor |

172,233.0 |

3,487.0 |

|

9 |

General Electric |

152,866.0 |

16,819.0 |

|

10 |

Total |

152,609.5 |

11,955.0 |

|

11 |

Chevron Texaco |

147,967.0 |

13,328.0 |

|

12 |

ConocoPhillip |

121,663.0 |

8,129. |

|

13 |

AXA |

121,606.3 |

3,133.0 |

|

14 |

Allianz |

118,937.2 |

2,735.0 |

|

15 |

Volkswagen |

110,648.7 |

842.0 |

|

16 |

Citigroup |

108,276.0 |

17,046.0 |

|

17 |

ING Group |

105,886.4 |

7,422.8 |

|

18 |

Nippo Telegraph & Telephone |

100,545.3 |

6,608.0 |

|

19 |

American Intl. Group |

97,987.0 |

9,731.0 |

|

20 |

Int'l Business Machine |

96,293.0 |

8,430.0 |

|

21 |

Siemens |

91,493.2 |

4,144.6 |

|

22 |

Carrefour |

90,381.7 |

1,724.8 |

|

23 |

Hitachi |

83,993.9 |

479.2 |

|

24 |

Assicurazioni Generali |

83,267.6 |

1,635.1 |

|

25 |

Matsushita Electric Industrial |

81,077.7 |

544.1 |

|

26 |

McKesson |

80,514.6 |

-156.7 |

|

27 |

Honda Motor |

80,486.6 |

4,523.9 |

|

28 |

Hewlett-Packard |

79,905.0 |

3,497.0 |

|

29 |

Nissan Motor |

79,799.6 |

4,766.6 |

|

30 |

Fortis |

75,518.1 |

4,177.2 |

|

31 |

Sinopec |

75,076.7 |

1,268.9 |

|

32 |

Berkshire Hathaway |

74,382.0 |

7,308.0 |

|

33 |

ENI |

74,227.7 |

9,047.1 |

|

34 |

Home Depot |

73,094.0 |

5,001.0 |

|

35 |

Aviva |

73,025.2 |

1,936.8 |

|

36 |

HSBC Holdings |

72,550.0 |

11,840.0 |

|

37 |

Deutsche Telekom |

71,988.9 |

5,763.6 |

|

38 |

Verizon Communications |

71,563.3 |

7,830.7 |

|

39 |

Samsung Electronics |

71,555.9 |

9,419.5 |

|

40 |

State Grid |

71,290.2 |

694.0 |

|

41 |

Peugeot |

70,641.9 |

1,687.8 |

|

42 |

Metro |

70,159.3 |

1,028.6 |

|

43 |

Nestlé |

69,825.7 |

5,405.4 |

|

44 |

U.S. Postal Service |

68,996.0 |

3,065.0 |

|

45 |

BNP Paribas |

68,654.4 |

5,805.9 |

|

46 |

China National Petroleum |

67,723.8 |

8,757.1 |

|

47 |

Sony |

66,618.0 |

1,524.5 |

|

48 |

Cardinal Health |

65,130.6 |

1,474. |

|

49 |

Royal Ahold |

64,675.6 |

542.3 |

|

50 |

Altria Group |

64,440.0 |

9,416.0 |

[Chart Courtesy of Forbes]

NATION-STATES

|

Rank |

Country |

Gross Domestic Product |

Date of Information |

|

1 |

$ 59,380,000,000,000 |

2005 est. |

|

|

2 |

$ 12,370,000,000,000 |

2005 est. |

|

|

3 |

$ 12,180,000,000,000 |

2005 est. |

|

|

4 |

$ 8,158,000,000,000 |

2005 est. |

|

|

5 |

$ 3,867,000,000,000 |

2005 est. |

|

|

6 |

$ 3,678,000,000,000 |

2005 est. |

|

|

7 |

$ 2,446,000,000,000 |

2005 est. |

|

|

8 |

$ 1,867,000,000,000 |

2005 est. |

|

|

9 |

$ 1,816,000,000,000 |

2005 est. |

|

|

10 |

$ 1,645,000,000,000 |

2005 est. |

|

|

11 |

$ 1,580,000,000,000 |

2005 est. |

|

|

12 |

$ 1,535,000,000,000 |

2005 est. |

|

|

13 |

$ 1,077,000,000,000 |

2005 est. |

|

|

14 |

$ 1,066,000,000,000 |

2005 est. |

|

|

15 |

$ 1,014,000,000,000 |

2005 est. |

|

|

16 |

$ 983,300,000,000 |

2005 est. |

|

|

17 |

$ 899,000,000,000 |

2005 est. |

|

|

18 |

$ 642,700,000,000 |

2005 est. |

|

|

19 |

$ 610,800,000,000 |

2005 est. |

|

|

20 |

$ 551,600,000,000 |

2005 est. |

|

|

21 |

$ 551,600,000,000 |

2005 est. |

|

|

22 |

$ 545,800,000,000 |

2005 est. |

|

|

23 |

$ 537,200,000,000 |

2005 est. |

|

|

24 |

$ 527,400,000,000 |

2005 est. |

|

|

25 |

$ 500,000,000,000 |

2005 est. |

|

|

26 |

$ 489,300,000,000 |

2005 est. |

|

|

27 |

$ 451,300,000,000 |

2005 est. |

|

|

28 |

$ 385,200,000,000 |

2005 est. |

|

|

29 |

$ 340,500,000,000 |

2005 est. |

|

|

30 |

$ 337,900,000,000 |

2005 est. |

|

|

31 |

$ 329,300,000,000 |

2005 est. |

|

|

32 |

$ 321,200,000,000 |

2005 est. |

|

|

33 |

$ 303,100,000,000 |

2005 est. |

|

|

34 |

$ 299,900,000,000 |

2005 est. |

|

|

35 |

$ 269,400,000,000 |

2005 est. |

|

|

36 |

$ 266,500,000,000 |

2005 est. |

|

|

37 |

$ 262,100,000,000 |

2005 est. |

|

|

38 |

$ 254,200,000,000 |

2005 est. |

|

|

39 |

$ 251,800,000,000 |

2005 est. |

|

|

40 |

$ 248,000,000,000 |

2005 est. |

|

|

41 |

$ 242,800,000,000 |

2005 est. |

|

|

42 |

$ 237,000,000,000 |

2005 est. |

|

|

43 |

$ 194,800,000,000 |

2005 est. |

|

|

44 |

$ 194,700,000,000 |

2005 est. |

|

|

45 |

$ 186,400,000,000 |

2005 est. |

|

|

46 |

$ 184,900,000,000 |

2005 est. |

|

|

47 |

$ 182,100,000,000 |

2005 est. |

|

|

48 |

$ 180,600,000,000 |

2005 est. |

|

|

49 |

$ 168,900,000,000 |

2005 est. |

|

|

50 |

$ 161,700,000,000 |

2005 est. |

[Chart Courtesy of CIA Facts]

The power and sphere of influence that these giants wield is most intimidating to all but a few of the largest nations in the world. Remember, developing countries are essentially competing to win transnational corporation’s investments: both in regards to creating jobs as well as generating revenues.

When a transnational giant sets up shop in a new foreign land, especially in a developing nation, its powerful sphere of influence affects the entire process: social policies, political policies, environmental issues, taxes, labor rules, accounting, campaign contributions, and many other related issues that collectively have a huge impact on the host environment.

The World Development Report 2005: An Unbalanced Message on Investment Liberalization” has much to say regarding the issue of TNC’s influence on the host country.

“The report states that non-transparent or unpredictable governmental policies and behaviors may adversely affect investors’ decisions and thereby chill incentives to invest in a particular country. The report cites surveys among firms and investors indicating that issues relating to policy and regulatory uncertainty dominate investor concerns vis-à-vis developing countries, and that reducing government-related regulatory or policy risks can increase the probability of new investments by more than 30 percent.

It is also argued that selective or targeted policy interventions with respect to promoting certain investment areas or industrial sectors often end up failing to meet their objectives, and stresses that such measures are more likely to succeed when they complement rather than attempt to substitute for broader investment climate improvements.

Therefore, instead of prioritizing selective interventions, governments should put their energy into improving the underlying causes of disadvantages for firms (such as the inadequacy of the infrastructure, ambiguity in property rights, red tape, corruption, etc.), in which case selective interventions may not be necessary.” [13]

The Trade Off

The competition in the world of business is not for the faint of heart. The competition between countries, especially developing countries, to land a transnational corporation on its home territory is very intense – to put it mildly.

There is much at stake for many different players: the transnational corporation itself, the host country, the immediate local environment where the company sets up shop, and the affects on the countries that were in competition for the direct investment flows and lost out on the opportunity.

“It is also argued that that selective or targeted policy interventions with respect to promoting certain investment areas or industrial sectors often end up failing to meet their objectives, and stresses that such measures are more likely to succeed when they complement rather than attempt to substitute for broader investment climate improvements.

Therefore, instead of prioritizing selective interventions, governments should put their energy into improving the underlying causes of disadvantages for firms (such as the inadequacy of the infrastructure, ambiguity in property rights, red tape, corruption, etc.), in which case selective interventions may not be necessary.” [14]

Globalists contend that they contribute to the betterment of the developing countries investment climate, which in turn will bring in foreign direct investment flows (FDI). Increased levels of economic growth and development will then materialize, which will spur growth and reduce poverty.

“However, the authors of the report make no effort to provide empirical evidence in support of the sweeping assertion that increased FDI flows would lead to reduced poverty and higher living standards in developing countries. The report also contains no evaluation of the levels of gross and net flows, of the quantity versus the quality of foreign investment and of the country and sectoral composition of these flows. An analysis of all these aspects of foreign investment is needed to determine the net benefit.” [15]

Corporate taxes have become a main driver of a host country’s attractiveness for foreign direct investment. This is especially true if competing nation’s jurisdictions have similar or better “enabling conditions”. As stated earlier, transnational corporations can bring powerful influences to bear on the host country – even to the point of affecting the prevailing corporate income tax rates.

Foreign Direct Investment

Foreign direct investment (FDI) contains an equity stake of 10% or more in a foreign enterprise. A transnational corporation whose home base is in one country sets up a business interest in a foreign host country. Foreign direct investment (FDI) has three basic components: equity capital, intra-company loans, and reinvested earnings.

For 2005, FDI increases received support from rising profits and economic growth that together provided a more favorable overall business climate. Data on the financing components of FDI show that the trends of FDI in both developed and developing countries were largely determined by equity investment.

Note that all figures for FDI are denominated in US dollars. Consequently, all foreign currencies are exchanged into dollar amounts for comparison. Therefore, movement in foreign exchange rates between foreign currencies and the dollar have an impact of FDI flows.

“Firms may enter host economies through greenfield investments or M&As. The choice of mode is influenced by industry-specific factors. For example, greenfield investment is more likely to be used as a mode of entry in industries in which technological skills and production technology are key. The choice may also be influenced by institutional, cultural and transaction cost factors in particular, the attitude towards takeovers, conditions in capital markets, liberalization policies, privatization, regional integration, currency risks and the role played by intermediaries (e.g. investment bankers) actively seeking acquisition opportunities and taking initiatives in making deals.” [16]

The Bankers

Notice the mention of investment bankers. We have not heard very much concerning bankers in all this transnational globalization discussion. Yet they are there, both behind the scenes in the shadows and amongst the combatants on the field, as intermediaries or middlemen, sometimes known as moneychangers.

Remember, when all is said and done – money is what moves the wheels of modern commerce. Likewise, if one were to search out the names of the largest stockholders of the largest transnational corporations, one might be surprised at the concentration of elite collectivist families that own the TNCs that own the world.

Central banking, the United Nations, the International Monetary Fund, the Bank For International Settlements, the Bretton Woods Accord, the Federal Reserve – all of these institutions were developed by the self-same few elite international financiers and banking families.

Just as most business is concentrated within the top ten transnational corporations, so too is the world’s wealth concentrated in the hands of the thirteen top elite families: the crème de le crème. The apple does not fall far from the tree.

The chart below shows the disparity between those that have and those that have not. Wealth is becoming increasingly concentrated – in fewer and fewer hands, which is supposedly not the mission of the United Nations and their bevy of international institutions, yet that is exactly what is occurring.

“TNCs from five countries: France, Germany, Japan, the United Kingdom and the United States dominate the list, accounting for 70% of all companies in the top 50 and 74% of their total assets.” [17]/p>

[Courtesy of WIR]

Many developing nations are questioning just how effective foreign direct investment by transnational corporations is in helping the host country as opposed to helping the TNC.

“India raised many of the concerns of developing countries on the quality of FDI flows in its submission to the WTO: …‘more’ is not necessarily ‘better’ in the case of multinational corporate activities in developing countries. Studies have shown that between 25 and 45 per cent of FDI has a demonstrably negative impact on host societies. That is, the costs in terms of using scarce domestic resources inefficiently substantially outweigh the benefits of national income.”

“The risks associated with foreign investment flows relate to the impact of these flows on the balance of payments, macroeconomic management, the exchange rate, restrictions in the transfer of technology, and crowding out of domestic enterprises. In other words, FDI may have both a short and a longer-term structural influence on the composition of a country’s external payment flows […] unfettered FDI may create a time profile of foreign exchange outflows (in the form of dividend payments or profits repatriation) and inflows (e.g. fresh FDI) which may be time inconsistent. Experience shows that such incompatibility, even in the short run, may easily produce a liquidity crisis [which could in turn] degenerate into a solvency crisis with serious adverse consequences for economic development.” [18]

The Asian Financial Crisis of 1997-98, as well as the problems in South America (Argentina for example) and other developing countries such as Africa have been the recipients of the results of globalization according to the new world order: most easily summed up by “move out of the way and go to the back of the bus please.”

“The opposition of developing countries to the proposals for the negotiation of new binding international rules and disciplines to govern FDI arises out of their experience of the negative effects of the trade and investment liberalization initiatives that many have undertaken as a result of World Bank loan conditionalities or IMF structural adjustment programs. Developing countries have also experienced the adverse social, environmental, economic and financial effects of unregulated FDI and portfolio investments by TNCs. These concerns were inadequately addressed in WDR 2005.” [19]

Mergers and Acquisitions

Mergers and acquisitions increased to approximately $ 2.9 trillion dollars, an increase of about 40%. Higher share prices on most of the major stock markets contributed to the increase. The weakening of the U.S. dollar also contributed to the increase in FDI flows into the U.S., as well as other countries (China) whose currency is pegged to the U.S. dollar.

“Mergers and Acquisitions have acquired growing importance as a form of investment in developing countries in recent years and this has raised many concerns about the net benefits of this type of investment. A particularly troublesome issue is that FDI entry via an acquisition may not represent any addition at all to the capital stock, output or employment of the host country. Also, if FDI takes the form of acquisition of host country corporations on the stock market, the net result could be that of the best developing country corporations being acquired by the much larger multinationals even though the latter would not be as efficient as the acquired corporations.” [20]

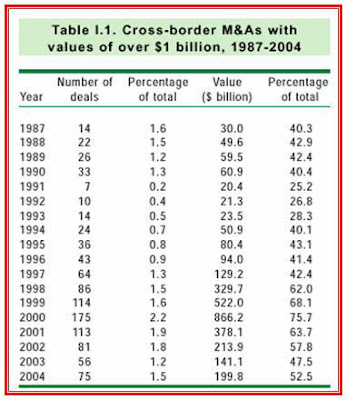

The following chart shows the cross-border mergers and acquisitions with values over $1 billion dollars between 1984-2004. Note how the totals steadily rose in value until peaking in 2000. Since 2000, they have steadily declined by between 50 to 66%, depending on the given year under review.

[Source: UNCTAD, cross-border M&A database]

FDI is financed by TNCs through equity capital, intra-company loans and reinvested earnings. Equity capital has been the largest source of financing comprising approximately 67% of foreign direct investment flows from 1995 to 2005.

The average share of equity capital in annual FDI flows was 85% in the United States, 78% in Germany, and between 50% and 70% in Finland, Norway, Switzerland and the United Kingdom. The chart below illustrates the dominance of equity capital in financing FDI flows.

Components Share of FDI Flows

Bilateral Investment Treaties

The most favored vehicle for foreign direct investment by transnational corporations is the bilateral investment treaty (BIT), although their use is not growing at the rates of previous years, while new types of international investment agreements (IIA) receive expanding usage.

Out of the approximate 2500 BIT’s signed to date, only 70% are actually in force. Various reasons are given: formal requirements vary from country to country regarding the ratification and subsequent enactment of treaties, lack of coordination and communication between and within countries may occur, as well as political problems, civil unrest or war.

“It is important to note in this context that the signature of a treaty itself has legal implications for its parties. According to Article 18 of the Vienna Convention on the Law of Treaties, A State is obliged to refrain from acts which would defeat the object and purpose of a treaty when:

(a) It has signed the treaty or has exchanged instruments constituting the treaty subject to ratification, acceptance or approval, until it shall have made its intention clear not to become a party to the treaty; or

(b) It has expressed its consent to be bound by the treaty, pending the entry into force of the treaty and provided that such entry into force is not unduly delayed”. [21]

In response, The World Development Report 2005: An Unbalanced Message on Investment Liberalization had the following to say:

“The WDR 2005 argues that such international agreements will lead to greater flows of investment. This outcome is not guaranteed but the report asserts that there is evidence that investors rely on the assurances provided by binding international agreements to invest. However, the WDR 2005 does not provide any evidence in support of this assertion.

To the contrary, the report acknowledges that empirical studies have not identified a link between the conclusion of bilateral investment treaties (BITs) and increased investment flows. In an attempt to reconcile this contradiction, the WDR 2005 makes the amazing claim that lack of awareness and understanding by investors of the existence of BITs may be preventing a stronger response in terms of increased investment flows.” [22]

Consequently, after a half-century of work the results are contradictory at best and amazingly incongruent at worst. In the words of the Governance Reform of the Bretton Woods Institutions and the UN Development System of May 2005 that states:

“Sixty years after the creation of the United Nations and the Bretton Woods institutions, the world faces some serious old and new global challenges: hunger, poverty, and social polarization are a heavy burden for the idea of justice. Global population growth continues to exacerbate these problems, forcing the international community to focus on sustainability as an organizing principle, not only for environmental policies and strategies but also for economic policy, energy, and the manufacturing industry. Global climate change and the loss of biodiversity has become a serious environmental and security issue. While these and other threats (HIV/AIDS, malaria, tuberculosis, catastrophic diseases, as well as environmental health risks) continue to grow as global issues, the necessary global governance capacities and institutions are still weak and not up to the task of addressing these threats. We believe that the Millennium Development Goals and the Agenda for Sustainable Development cannot be met without serious efforts to reform the architecture of global governance.”

“The reform proposals made in this study are aimed at strengthening and improving the main multilateral development institutions. In particular, the Bretton Woods institutions and the UN development system need to improve their cooperation by synchronizing their development strategies. Both the UN and the Bretton Woods institutions have important, different, and at the same time common roles to play.

In fact, their commonality is clearly visible in the origins of the post-World War II architecture, in which the Bretton Woods institutions, though first by birth right, formed part of a one-world strategy, which was the intention of the founding fathers of the post-World War II international order. This spirit is still the best idea to address serious global issues in the absence of a world government.” [23]

Unilateral New World Order

The language used in the above paragraph is most telling, both in what it says and does not say; and by that which is alluded to in muted undertones of incongruity. We will start at the end, as the end is the result of the cause, which came before.

The “absence of a world government” is lamented, the pretext for the “best ideas to address serious global issues.” Next “the intentions of the founding fathers of the post-World War II international order” is said to have been “a one-world strategy.”

The “one-world strategy” is the child of the Bretton Woods institutions in conjunction with the UN. Furthermore, it states that the reform proposals of the study that follows are “aimed at strengthening and improving the main multilateral development institutions” (Bretton Woods and the UN).

We offer a few observations:

-

A one-world strategy exists only to create a one-world government.

-

An international order, which existed after World War II, is decisively different from a one-world order.

-

A one-world government is a bit different from multilateral institutions within an international order.

-

The preferred new world order is a unilateral order of transnational corporations that seek a global one-world marketplace, a global one-world currency, and a global one-world overlord to enforce the laws of the one-world court of the new world order.

Conclusion

To say the times are a changing, or that we live in interesting times no longer expresses the seriousness of what is going on in the world today. Mankind has come to an important fork on the path of his journey. Important decisions that will affect all of mankind are calling forth to be made. One wonders if the leaders of the world literally know what they are doing, or why they are doing it, and for whom they are doing it.

For over a half century the existing international order has poured billions upon billions of dollars into program after program. Cui Bono? New and improved organizations and committees have appeared, with new leaders that supposedly have a clear vision of how to construct a better future to be.

Humankind faces grave problems: of hunger, malnutrition, lack of clean water, inadequate education, disease, poverty, and protection of himself and the biosphere. The leaders and experts in their various fields must realize that using the same types of external solutions of the past cannot solve the complex problems of today.

The programs that are today regarded as obsolete and outdated were the cutting edge solutions for the future just 50 years ago. Now the junk pile is their new home – because they did not fulfill the expectations of their creators – or did they.

I offer a simple solution; no let us call it a suggestion taken under advisement, to help in the corrective process to nurture world peace and posterity.

The basis of physical existence requires the necessities of life to be available to all. This means that trade and commerce must exist for man to exist. And what is the basis of all trade and commerce in today’s world – money; the common medium of exchange for all that man’s labor produces and provides.

Unfortunately, the powers that fought and financed WWII are the same powers that created the UN, and the IMF, and the World Bank, and the WTO – the same powers that created paper fiat money; and central banking according to fractional reserve lending and legal tender laws.

The many world problems cannot be solved unless that which supports man’s labor and trade is sound and sturdy – the monetary unit of account. The real story of the present world condition is one of DEBT AND WEALTH TRANSFERENCE.

Many of today’s developing nations are home to the oldest civilizations on earth. How is it that they could not better themselves in thousands of years, yet the United States has progressed to world leadership in 300 years, and previously Great Britain in less than a thousand years?

What nation went to India, China, Australia, Africa, and the Middle East to establish its empire? If the countries that were exploited had nothing worth exploiting, than the world’s elite collectivists would not have set up shop there. Once they did establish themselves, they bled the country dry. That is the reason there are so many third world undeveloped nations. It is very difficult to develop when you have been under another’s thumb holding you down for so long.

The simple solution: take the thumb off the people of the world, forget about world domination and world government – who died and left them king? If world leaders truly want to accomplish something positive than return Gold and Silver to its rightful place as Honest Money.

Only honest men can have a system of Honest Money. Only a system of Honest Money is sound enough and strong enough to be the basis of any solution for the present world condition. A stone house is not made with straw. A house of cards cannot withstand the savage and forever changing winds of fortune.

Perhaps more than just the institutions are at fault – perhaps the men that run the institutions at various times are at fault as well. In the memoirs of one U.S. Secretary of State we find the fertile ground that bred the post WWII version of The New World Order:

"The Security Council is not a body that merely enforces agreed law. It is a law unto itself. No principles of law are laid down to guide it; it can decide in accordance with what it thinks is expedient." [24]

Such self-aggrandizement is at best illusional, and at worst delusional. All those that have come before, are now long gone. And this too shall come to pass:

“He breath’d prolific soul, inspir’d the land

And call’d forth order, with directive hand

Then, pour’s whole energy, at once spread wide,

And old obstruction sunk, beneath the tide.

Then, shad’wing all, the dread dominion rose,

Which, late, no hope, and now, no danger knows.” [25]

Look For An Open Letter To Congress Coming In March

Seeking Redress For Honest Money

© 2006 Douglas V. Gnazzo

All rights reserved. Any republication without written permission

of author and Financial Sense prohibited.

[1] Joel Bleifuss, In These Times magazine

[2] Jeremy Brecher, Historian and Author

[3] The United Nations Conference on Trade and Development

[4] World Investment Report 2005

[5] United Nations Conference On Trade And Development [press release dated

1/23/06]

[6] Preface To The World Development Report 2005

[7] The United Nations Conference on Trade and Development dated January 23,

2006

[8] The World Development Report 2005 An Unbalanced Message On

Investment Liberalization

[9] As above

[10] UN Economic and Social Council Commission On Human Rights 15 Feb.

2005

[11] As above

[12] Security Council by Dr Danesh D. Saroosh

[13] The World Development Report 2005

[14] As abovebr /> [15] As above

[16] World Investment Report2005 Transnational Corporations and the

Internationalization of R&D, Chapter One: Global Trends: FDI Flows Resume

Growth

[17] World Investment Report 2005

[18] The WDR 2005 An Unbalanced Message On Investment Liberalization

[19] As above

[20] Same

[21] WIR 2005

[22] The WDR 2005

[23] Governance Reform of the Bretton Woods Institutions and the UN Development

System

of May 2005

[24] The Memoirs “War or Peace” by US Secretary of State John

Foster Dulles

[25] Aaron Hill – Poet 1718

About the author: Douglas V. Gnazzo is CEO of New England Renovation LLC, a historical restoration contractor that specializes in restoring older buildings that are vintage historic landmarks. He writes for numerous websites and his work appears both here and abroad. Just recently he was honored by being chosen as a Foundation Scholar for the Foundation of Monetary Education (FAME).

Disclaimer:

The contents of this article represent the opinions of Douglas V. Gnazzo. Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Douglas V. Gnazzo is not a registered investment advisor. Information and analysis above are derived from sources and using methods believed to be reliable, but Douglas. V. Gnazzo cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions. This article may contain information that is confidential and/or protected by law. The purpose of this article is intended to be used as an educational discussion of the issues involved. Douglas V. Gnazzo is not a lawyer or a legal scholar. Information and analysis derived from the quoted sources are believed to be reliable and are offered in good faith. Only a highly trained and certified and registered legal professional should be regarded as an authority on the issues involved; and all those seeking such an authoritative opinion should do their own due diligence and seek out the advice of a legal professional. Lastly Douglas V. Gnazzo believes that The United States of America is the greatest country on Earth, but that it can yet become greater. This article is written to help facilitate that greater becoming.

Disclaimer